Fashion

What’s Actually Cheaper? GST vs No GST (Let’s go Shopping)

Introduction

Ever felt like your grocery bill was higher than expected—even though you didn’t buy much? You’re not alone. That sneaky little extra might just be the Goods and Services Tax, or GST for short.

In Australia, GST is a 10% tax added to most goods and services you use every day—from takeaway meals to your favourite shampoo. But here’s the twist: not everything gets taxed.

So, what’s actually cheaper—items with GST or those without? Let’s unpack this mystery by comparing two shopping baskets side by side. One full of GST items, the other GST-free. Let the price showdown begin!

The GST Basics – Quick & Simple

GST—short for Goods and Services Tax—is a 10% tax added to most things you buy in Australia. From your morning coffee to a new pair of trainers, it’s included in the final price.

But here’s the good news—not everything is taxed. Some items are GST-free, like fresh fruit, veggies, and basic health services. Surprising, right?

You don’t pay GST directly to the government. Instead, businesses include it in what you pay and then pass it on through their tax returns. So while you might not see it, you’re definitely paying it—every time you tap your card or scan a barcode.

The GST Basket – What’s Taxed?

Let’s talk about the everyday items that come with GST built right in—whether you notice it or not. Soft drinks, crisps, chocolates and lollies? All taxed.

Your favourite shampoo, toothpaste, and even deodorant? Yep, they’re on the GST list too. Clothing, shoes, and those shiny new electronics—also included. And don’t forget your dinner out at a café or restaurant—that’s got GST added as well.

The important bit to remember is this: most prices in shops already include GST, unless it’s clearly stated otherwise. So while you don’t see it separated, it’s quietly baked into the cost of your everyday buys.

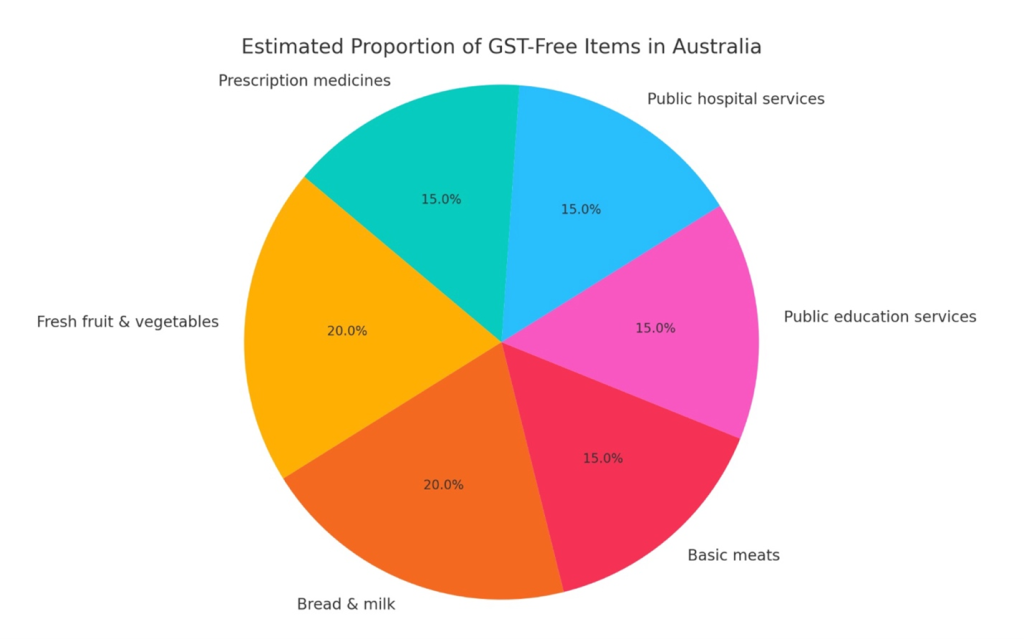

Figure 1: Here’s the pie chart showing the estimated proportions of GST-free items in Australia. Let me know if you’d like to adjust the proportions, colors, or style!

The No-GST Basket – What’s Exempt?

Now, let’s peek into the no-GST basket—the one that gives your wallet a little breather. These are the essentials that don’t carry the 10% tax, making them just that bit more budget-friendly.

Think fresh fruit and veg, loaves of bread, and bottles of milk. Basic meats like chicken or mince? Also GST-free. It doesn’t stop at food—public education and hospital services are exempt too.

Even your prescription medicines skip the tax. Surprising, isn’t it? Some of life’s everyday basics come without that extra cost. It’s a quiet saving you make, without even realising it. Now that’s something to smile about.

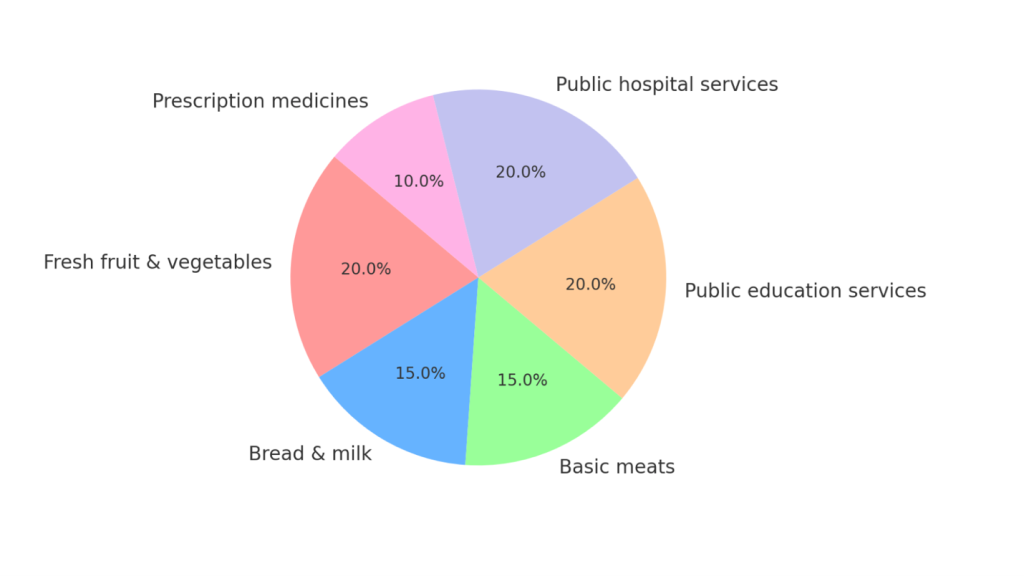

Figure 2: Here’s the pie chart showing the estimated proportions of GST-free items in the “No-GST Basket.” Let me know if you want a version with different colors, proportions, or formatted for a blog or presentation.

Side-by-Side: The Shopping Basket Challenge

Let’s take the “Shopping Basket Challenge” and compare two weeks of groceries.

In Basket A, you’ve got the usual mix: soft drinks, crisps, toiletries, and maybe a pair of shoes or some electronics. All taxed with GST, adding that extra 10% to the total.

In Basket B, it’s mostly GST-free essentials—fresh fruit, veggies, bread, milk, and some basic meats. No tax added here!

When we add up the totals, Basket A ends up costing a little more, thanks to those GST charges. The small differences might seem insignificant, but over time, they can really add up to noticeable savings.

When GST-Free Doesn’t Mean “Always Cheaper’’

Now here’s a twist—just because something is GST-free doesn’t always mean it’s cheaper. Surprising, isn’t it?

Let’s say you pick up some organic apples. They’re GST-free, yes—but often pricier than a pack of processed snack bars that do include GST.

The same goes for gluten-free bread, specialty meats, or artisan dairy products. These might dodge the tax, but their premium price tags can still stretch your budget.

So while GST-free items sound like a smart choice, it’s worth looking at the full picture. Sometimes, the taxed option ends up being more affordable overall.

Why Does This Matter?

So, why does any of this really matter? Well, for everyday shoppers, knowing what’s taxed and what’s not can make a real difference at the checkout. It helps you plan your weekly spend and spot where that extra 10% is sneaking in.

For businesses, especially small ones, understanding which items are GST-free is vital. It affects how you price your goods and how you manage your invoicing and tax returns.

And for families? Those little savings add up. A few dollars here and there might not seem much, but over the year, it can mean hundreds saved—just by shopping smarter.

Tips to Shop Smart with GST in Mind

Want to stretch your budget a little further? Shopping smart with GST in mind can really help. Start by mixing GST-free staples like fresh produce and bread with the occasional treat—there’s no harm in a chocolate bar now and then!

Keep an eye on your receipts. Many list GST as a separate line, so you can see exactly where your money’s going. It’s a simple habit that can reveal a lot.

And don’t be shy—ask small business owners if their prices include GST. Most do, but it’s always good to know what you’re actually paying for, pound for pound.

Conclusion

So there you have it—GST touches more of your daily shop than you might think. But with a bit of know-how, you can shop smarter and save along the way.

Why not try the basket challenge yourself? Think you can build a no-GST basket for under $50? Share it with us!

You must be logged in to post a comment Login